Industries Overview

Our research focuses on the five core coverage areas below. We apply our rigorous research methodology to our reports, charts, forecasts, and more to keep our clients at the forefront of key developments and trends before they hit the mainstream.

Latest Articles

Browse All →US student loan forgiveness will give 73,000 US consumers extra cash—and they’ll want help saving and investing it

Article |

Jan 24, 2024

Third-party intermediaries haven’t caught up with grocers

Article |

Jan 24, 2024

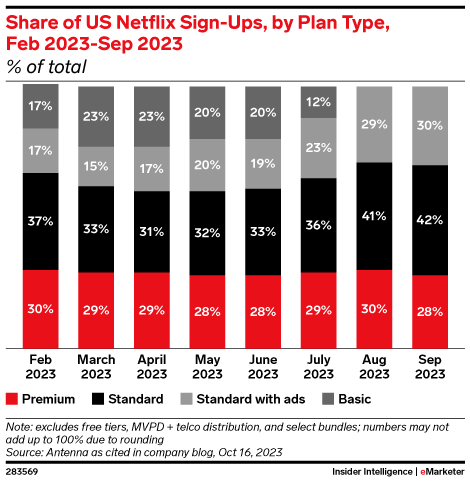

2023 was a strong year for Netflix. With the WWE, the future looks even brighter.

Article |

Jan 24, 2024

5 factors driving the growth of beauty and cosmetics sales

Article |

Jan 24, 2024

Shoppers want AI to help with product research and customer service

Article |

Jan 23, 2024

US ad agencies approach 2024 with a mix of optimism and economic caution

Article |

Jan 23, 2024

5 charts showing the potential of text message (SMS) marketing

Article |

Jan 23, 2024

84.51° exec: Consumers remain concerned with inflation and retailers must balance digital and physical for success in 2024

Article |

Jan 23, 2024

Cookie deprecation won’t change advertisers’ preferred transaction methods

Article |

Jan 23, 2024

Walmart’s lackluster protection of financial services customers raises questions about unregulated nonbanks

Article |

Jan 22, 2024

Products

Insider Intelligence delivers leading-edge research to clients in a variety of forms, including full-length reports and data visualizations to equip you with actionable takeaways for better business decisions.

Forecasts

Interactive projections with 10k+ metrics on market trends, & consumer behavior.

Learn More →Charts

Proprietary data and over 3,000 third-party sources about the most important topics.

Learn More →Industry KPIs

Industry benchmarks for the most important KPIs in digital marketing, advertising, retail and ecommerce.

Learn More →About Insider Intelligence

Our goal at Insider Intelligence is to unlock digital opportunities for our clients with the world’s most trusted forecasts, analysis, and benchmarks. Spanning five core coverage areas and dozens of industries, our research on digital transformation is exhaustive.

Methodology

Rigorous proprietary data vetting strips biases and produces superior insights.

Learn More →Events

Browse our upcoming and past events, recent podcasts, and other featured resources.

Learn More →2023 was a strong year for Netflix. With the WWE, the future looks even brighter.

Insider Intelligence

Media Services

Free Content

Contact Us →

Worldwide HQ

One Liberty Plaza9th FloorNew York, NY 100061-800-405-0844

Sales Inquiries

1-800-405-0844ii-sales@insiderintelligence.com

* Copyright © 2024

Insider Intelligence Inc. All Rights Reserved.